31 January 2017

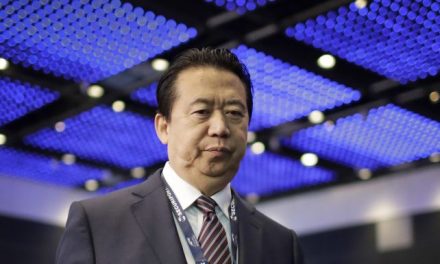

The picture above shows Lynden Scourfield, a former manager with HBOS.

Two former bankers and 4 business associates were convicted of fraudulent trading, corruption and money laundering. The fraud cost the bank. HBOS, to write off £266m in loans. HBOS is part of the Lloyds Banking Group. HBOS is the holding company for Bank of Scotland plc, which operates the Bank of Scotland and Halifax banks in the UK.

Lynden Scourfield, a former manager with HBOS, pleaded guilty to six counts including corruption. He was formerly head of a division that dealt with small companies in difficulty. Scourfield had crooked relationship with David Mills, a business consultant. Mills and his wife Alison, ran a restructuring consultancy under the style Quayside Corporate Services. This company is purported to do turnaround consultancy.

Scourfield would refer the businesses applying for financial facility to Quayside Corporate Services as a condition precedent to any facility from the bank. This gave Mills and his wife Alison not only the opportunity to charge exorbitant fees but also to take control of the various businesses and even to acquire ownership of them. Prosecution contended that the bank funding was improperly diverted between companies and to Mills entities. The clients’ businesses were run down so that Mills can take over the company. At first, they would insist on a seat on the board, or a shareholding, and eventually, control of the business.

David Mills owned expensive real estate, luxury cars and a yacht worth £2 million, all paid for by small business owners.

Michael Bancroft was David Mills’ associate. Bancroft and Mills arranged sex parties, exotic foreign holidays, cash in brown envelopes and other favours for Scourfield between 2003 and 2007.

On Monday Mills, 60, was convicted of six charges. Scourfield pleaded guilty to six counts. Mark Dobson, 56, a former HBOS banker was convicted of two charges. Mills’ wife Alison, 51, who was convicted of conspiracy to conceal criminal property. Michael Bancroft, 73, who was an associate of Mr Mills was convicted of five counts including conspiracy to corrupt. Tony Cartwright, 72, another business associate, was found guilty of fraudulent trading and conspiracy to conceal criminal property. They will be sentenced on Thursday.

HBOS discovered Scourfield’s unsanctioned loans in 2007. Just 18 months later the failing bank had to be taken over by Lloyds. The bailout cost £20.5billion to the taxpayer.

UK: Corruption of HBOS Bankers