10 May 2016

A third of the tax havens in the world are located in the British / Commonwealth territories. This is sufficient reason for the British PM to be concerned about.

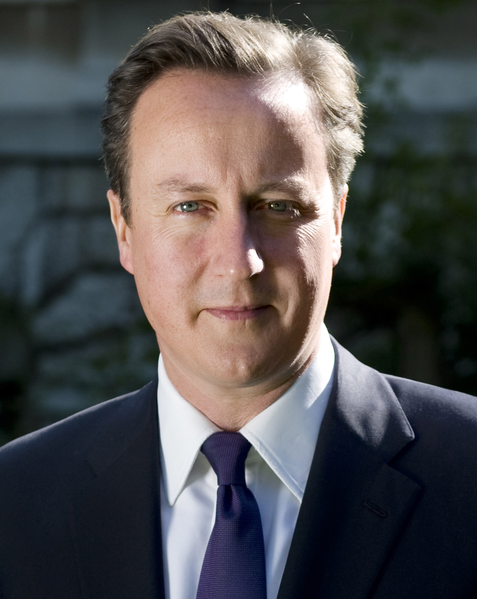

David Cameron, the British Premier, has called an anti-corruption summit to be held tomorrow. World leaders, NGOs and financial institutions have been invited for the meeting.

Not many of the heads of Commonwealth states are attending. Because they are the people who are stealing public funds and taking bribes and kickbacks. Cameron wants governments to disclose the beneficiaries of anonymous companies, and wants them to take further action to reduce the secrecy of offshore tax havens where they are incorporated. At the end of the day, Cameron will get only falsified reports from these Master crooks.

Here is an example of what is going to happen. Not long ago, Cameron was in Malaysia. It was during the peak of the 1MDB scandal. He was scheduled to talk with Prime Minister Najib abut the corruption. He probably did. At about the same time Transparency International also had its international conference in the capital city of Malaysia. None of these made an iota of difference in the affairs of Malaysia. Everything went on as usual and still it does. What then is the purpose of Cameron’s summit? Like dog’s tail these politicians can never be straight.

Panama papers revealed unprecedented disclosure of corrupt companies. Of the 210,000 companies exposed some 113,000 were registered in the British Virgin Islands. This is the legitimate concern of Cameron.

More than 300 economists signed a letter stating that the tax havens serve no useful purpose. This not quite true. They do some useful purpose. They protect assets in trusts if favour of minors from being plundered by some merciless relatives. The also protect through anonymity legitimate companies from harassment by oppressive politicians and extortionists.

Panama Papers showed, David Cameron – to take a prominent example – once had money that he had inherited from his father, in a tax haven but paid UK tax. Similarly, many companies in tax havens do pay tax.

Panama papers revealed that more than 500 banks, including their subsidiaries and branches, registered nearly 15,600 shell companies with Mossack Fonseca. These are the really bad money – from drugs, extortion, stealing and political funds.

ICIJ (International Consortium of Investigative Journalists) has made the Panama database public here.

Transparency International (TI) has said that Britain needs to overhaul its financial system to prevent dirty money flowing into Britain. TI pointed out that the existing supervisory system is woefully inadequate to stem the flow of dirty money into Britain. David Cameron has repeatedly said that dirty money is not welcome in the UK. One of the reasons why Cameron is so concerned about dirty money is that it was dirty money that enabled terrorists attack in France. Similar attacks could happen in UK also. Britain’s fast growing market for luxury properties is a big attraction for dirty money.

Britain is also guilty of harbouring economic criminals from third world countries. Because of the amount of wealth these criminals bring into the UK, they are able to get residency in Britain and protection from litigation in their native country where they plundered their wealth.

Cameron mentioned to the Nigeria and Afghanistan as “fantastically corrupt countries” to the Queen. This gaffe, unfortunately, got undue attention in the media. It is hoped that this will net undermine the efforts of Cameron. Nigerian President Muhammadu Buhari said that he was not seeking an apology from the British Prime minister but he is asking Britain to return the assets stolen by corrupt officials who fled to London. This is a legitimate request because many past politicians and governors are living in London even after conviction under British law. They continue to keep their assets.

Some 100,000 properties in London are owned by anonymous companies registered in tax havens. Britain will disclose the beneficial owners of these properties in the future. According to British government with this move corrupt individuals and countries will no longer be able to move, launder and hide illicit funds through London’s property market. This is not sufficient. The must be legislation to repatriate the proceeds from these assets to the countries from which the funds to purchase these properties were stolen.

An International Anti-Corruption Coordination Centre will be set up in London in partnership with the US, Canada, Australia, New Zealand, Switzerland, and Interpol.