1 August 2019.

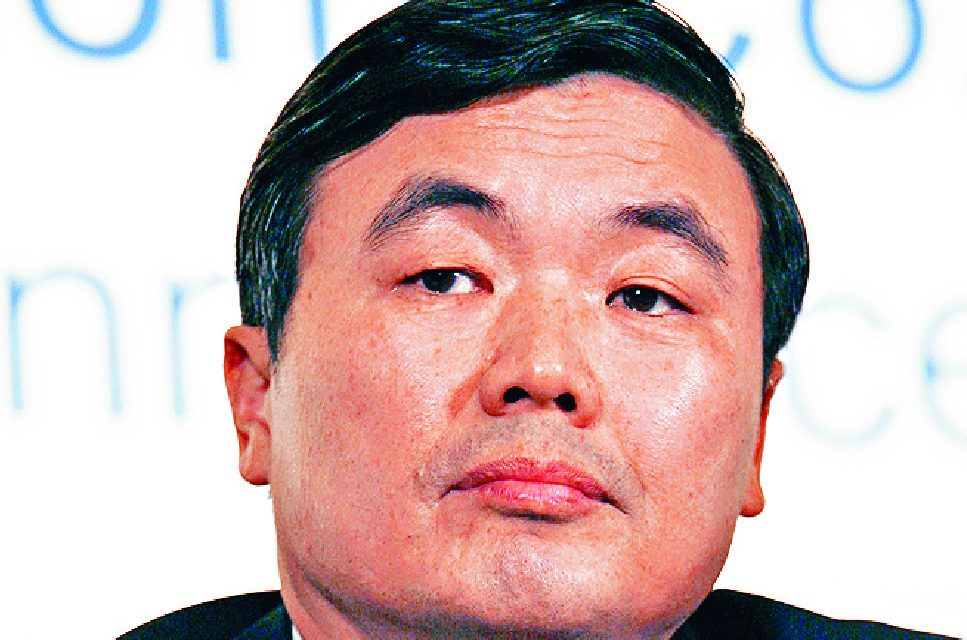

A former chairman of policy bank, China Development Bank (CDB), Hu Huaibang, who retired in September last year, has been placed under investigation for alleged corruption. Policy Banks are development banks responsible for financing economic and trade development and state-invested projects. Three “policy” banks are: Agricultural Development Bank of China (ADBC), China Development Bank (CDB), and the Export-Import Bank of China (Chexim). They were established in 1994.

Hu, 63, is alleged to have helped a CEFC subsidiary by facilitating a $4.8 billion credit line from CDB. This credit line enabled CEFC to acquire assets in Europe, the Middle East, Central Asia and Africa.

Soon after Hu’s retirement, allegations of a corrupt network linking Hu and Ye Jianming, founder of privately-owned energy and financial conglomerate CEFC China Energy Co. Ltd., surfaced in the graft trial of former Gansu province party chief Wang Sanyun.

Prosecutors accused Wang of taking bribes from Ye and using Hu as a go-between to offer help to Ye’s companies, state broadcaster China Central Television (CCTV) reported.

Hu and Wang have long been acquaintances. Prior to becoming Chairman of CDB, he was Chairman of Bank of Communications. At that time Wang Sanyun’s son, worked as a secretary to Hu for more than one year. Later when Hu was in CDB, the young Wang got a job at CDB’s Shanghai branch.

In April, Wang was sentenced to 12 years in prison for taking $10 million in bribes from 1993 and 2017.

The CEFC Shanghai International Group confirmed in May that it failed to make principal and interest payments on nearly $315 million in bonds because Ye has been unable to perform his duties. The company has since missed principal and interest payments on two other bonds worth a combined nearly 4.2 billion yuan that matured in late June and on Monday respectively. Another bond of a similar value will be due next month.

ARAB NEWS reported.

The CEFC Shanghai International Group confirmed in May that it failed to make principal and interest payments on nearly $315 million in bonds because Ye has been unable to perform his duties. The company has since missed principal and interest payments on two other bonds worth a combined nearly 4.2 billion yuan that matured in late June and on Monday respectively. Another bond of a similar value will be due next month.

ARAB NEWS reported.