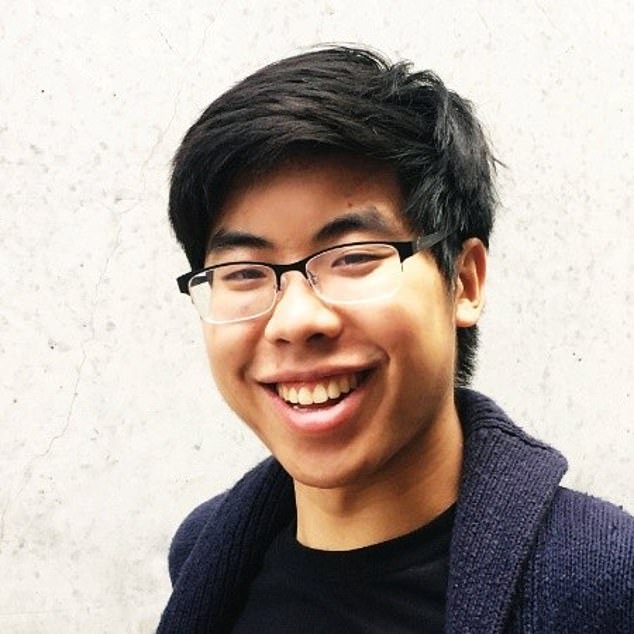

Stefan He Qin

9 February 2021

Stefan He Qin, A 24-year-old founder of two New York-based cryptocurrency hedge funds with more than US$100 million in assets pleaded guilty to securities fraud.

He duped investors by claiming he used a trading algorithm to take advantage of price differences for a number of cryptocurrencies.

In 2018, Qin, an Australian national and a University dropout, appeared on CNBC’s FastMoney and was profiled by The Wall Street Journal. The article said Qin returned 500 per cent in the year earlier, and the then-21-year-old was managing $23.5million.

Prosecutors said the fraud was revealed last summer when Qin was having difficulty meeting redemption requests from investors. He did not lose the money because the market turned on him. But he spent almost all the $90 million on ‘personal indulgences’, including food, services, rent and property investments.

Qin stole investor money from his Virgil Sigma Fund and attempted to dip into his VQR Multistrategy Fund LP to pay back investors in the first fund. He tried steal from yet another fund he controlled to cover VQR fund redemption demands. This cannot go on forever. So, his cryptocurrency hedge funds collapsed like a house of cards.

The US Securities and Exchange Commission filed a parallel civil case against Qin in December, 2020.

The Business Times reported.