4 November 2016

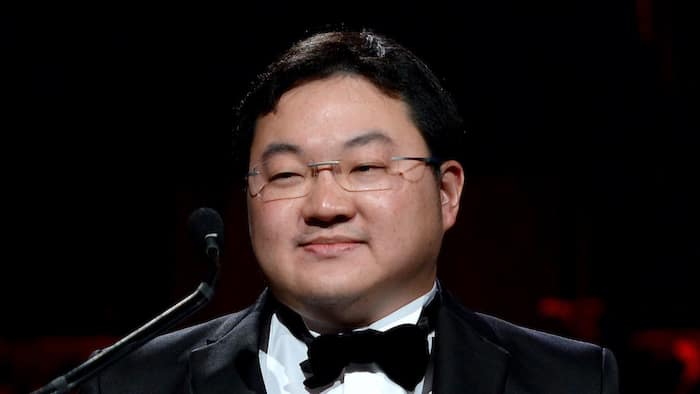

Prosecution has named Yeo Jiawei as the master mind behind a scheme that enabled Malaysian flamboyant businessman, Jho Taek Low, to funnel billions of dollars from Government owned company 1MDB. Jiawei was BSI (a Swiss private bank) wealth planner between December 2009 and July 2014. He left BSI in 2014 to work for Low Taek Jho for an annual remuneration of $500,000. He is reported to have amassed a $26 million by the age of 32, including from illicit schemes.

Two of the conspirators, Kevin Swampillai and Samuel Goh Sze Wei have become prosecution witnesses. Swampillai, a Malaysian, was Yeo’s former supervisor at BSI Bank. Goh, a chartered financial analyst, was formerly the head of agency distribution at NTUC Income. He introduced Bridge Partners International Management (Cayman) Ltd to BSI. They inked a deal with 1MDB-owned Brazen Sky to invest US$2.3 billion on its behalf. Goh profited at least US$300,000 for his involvement. Yeo later offered to split his share of the kickback equally with Mr Goh, raising his stake from US$150,000 to more than US$500,000 per year.

Yeo Jiawei and Kevin Swampillai concocted an elaborate and clandestine scheme of fund management which paid millions in kickbacks to the private bankers. The men pocketed about US$5 million from this scheme. Yak Yew Chee, another former BSI banker, was also involved in the scheme. Yak Yew Chee is facing charges separately. Yak is believed to have been Low’s private banker at BSI and at Coutts before that. Mr Yak claimed that had earned more than $27 million in salary and bonuses from the bank, from 2011 to 2015. But in a separate set of court papers, the bank’s lawyer Drew & Napier said that it had paid a total of $19.1 million to the banker from 2011 to 2015.

BSI was shut down in Singapore in May for allegedly helping to launder 1MDB money. It was also fined US$7 million for widespread failure control money-laundering activities related to 1MDB.

Six BSI Bank’s executives have been referred by the Monetary Authority of Singapore (MAS) to the Public Prosecutor to see if they have committed criminal offences. They are:

(1) Mr Hans Peter Brunner, 64, former CEO, a Swiss citizen, became a Singapore permanent resident in 2007. He worked for RBS Coutts before he joined BSI in 2009. He later got some 70 RBS Coutts staff to join him.

(2) Mr Raj Sriram, former deputy CEO, was interim head for one month after Mr Brunner left. In April, he resigned to take a “career break”.

(3) Mr Kevin Michael Swampillai, former head of wealth management services. He was an executive vice-president at RBS Coutts before he joined BSI.

(4) Yeo Jiawei, wealth planner, the first bank employee to be charged in relation to 1MDB.

(5) Mr Yak Yew Chee, former senior vice president at BSI Singapore who handled the bank’s relationship with 1MDB, has been charged with forgery and failure to disclose suspicious transactions.

(6) Ms Yvonne Seah Yew Foong, senior private banker

Prosecution has named Yeo Jiawei as the master mind behind a scheme that enabled Malaysian flamboyant businessman, Jho Taek Low, to funnel billions of dollars from Government owned company 1MDB. Jiawei was BSI (a Swiss private bank) wealth planner between December 2009 and July 2014. He left BSI in 2014 to work for Low Taek Jho for an annual remuneration of $500,000. He is reported to have amassed a $26 million by the age of 32, including from illicit schemes.

Two of the conspirators, Kevin Swampillai and Samuel Goh Sze Wei have become prosecution witnesses. Swampillai, a Malaysian, was Yeo’s former supervisor at BSI Bank. Goh, a chartered financial analyst, was formerly the head of agency distribution at NTUC Income. He introduced Bridge Partners International Management (Cayman) Ltd to BSI. They inked a deal with 1MDB-owned Brazen Sky to invest US$2.3 billion on its behalf. Goh profited at least US$300,000 for his involvement. Yeo later offered to split his share of the kickback equally with Mr Goh, raising his stake from US$150,000 to more than US$500,000 per year.

Yeo Jiawei and Kevin Swampillai concocted an elaborate and clandestine scheme of fund management which paid millions in kickbacks to the private bankers. The men pocketed about US$5 million from this scheme. Yak Yew Chee, another former BSI banker, was also involved in the scheme. Yak Yew Chee is facing charges separately. Yak is believed to have been Low’s private banker at BSI and at Coutts before that. Mr Yak claimed that had earned more than $27 million in salary and bonuses from the bank, from 2011 to 2015. But in a separate set of court papers, the bank’s lawyer Drew & Napier said that it had paid a total of $19.1 million to the banker from 2011 to 2015.

BSI was shut down in Singapore in May for allegedly helping to launder 1MDB money. It was also fined US$7 million for widespread failure control money-laundering activities related to 1MDB.

Six BSI Bank’s executives have been referred by the Monetary Authority of Singapore (MAS) to the Public Prosecutor to see if they have committed criminal offences. They are:

(1) Mr Hans Peter Brunner, 64, former CEO, a Swiss citizen, became a Singapore permanent resident in 2007. He worked for RBS Coutts before he joined BSI in 2009. He later got some 70 RBS Coutts staff to join him.

(2) Mr Raj Sriram, former deputy CEO, was interim head for one month after Mr Brunner left. In April, he resigned to take a “career break”.

(3) Mr Kevin Michael Swampillai, former head of wealth management services. He was an executive vice-president at RBS Coutts before he joined BSI.

(4) Yeo Jiawei, wealth planner, the first bank employee to be charged in relation to 1MDB.

(5) Mr Yak Yew Chee, former senior vice president at BSI Singapore who handled the bank’s relationship with 1MDB, has been charged with forgery and failure to disclose suspicious transactions.

(6) Ms Yvonne Seah Yew Foong, senior private banker

The probe was described as the Commercial Affairs Department’s (CAD) “most complex, sophisticated and largest” money laundering case by far.

Update

23 December 2016

Yeo Jiawei, former BSI wealth manager was sentenced to 30 months in jail for facilitating illicit transfer of funds linked to the Malaysian sovereign wealth fund, 1Malaysia Development Berhad (1MDB). Judge Ng said Yeo was an “unreliable” witness and “not credible”. Yeo violated his bail conditions while he was on bail. The bail conditions barred him from contacting other individuals being investigated by the CAD. He urged witnesses to lie to the police and told them to destroy evidence.

It was reported that he was “seriously considering appealing the conviction and sentence”.

It was reported that he was “seriously considering appealing the conviction and sentence”.