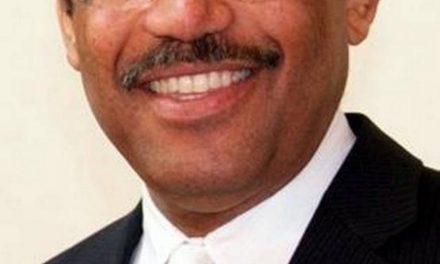

Reserve Bank governor Glen Stevens

Reserve Bank governor Glen Stevens

1 December 2012. Reserve Bank governor Glen Stevens has denied that the bank was ”asleep at the wheel”. But he conceded that it would have been ”prudent” for police to have been told of corruption concerns when they emerged in 2007. Mr Stevens has also told a parliamentary committee that a failure in governance may have contributed to the alleged bribe paid by the two Reserve banknote companies, Note Printing Australia and Securency. The bank failed to alert police to a 2007 when a whistleblower and senior banknote executive Brian Hood wrote a memo which detailed corruption and suspected bribe payment involving Note Printing Australia. This attracted criticism from the federal parliamentarians and ant-corruption experts. The bank instead of alerting police sought advice from a corporate law firm, Freehills, which found no breach of the law. The bank called the police only after Fairfax Media exposed the alleged bribes. Mr Stevens’ former deputy, Ric Battellino, told the hearing that public sector agencies and private companies needed to lower the bar when assessing if they should pass misconduct allegations to police. Mr Battellino said that reporting corruption allegations to police was ”a costless and easy thing to do” but that it had not occurred to him when allegations first surfaced in 2007. Both men have also been criticised by MPs for not telling previous hearings of Federal Parliament’s economics committee about the explosive Hood memo. Mr Stevens denied an accusation from Greens leader Senator Christine Milne that the RBA may have been ”asleep at the wheel” in not acting on corruption warning signs when they first emerged. Glenn Stevens has been rated as one of the world’s top-ranked central bank chiefs, coming in ahead of Federal Reserve chairman Ben Bernanke and European Central Bank president Mario Draghi.