3 October 2016

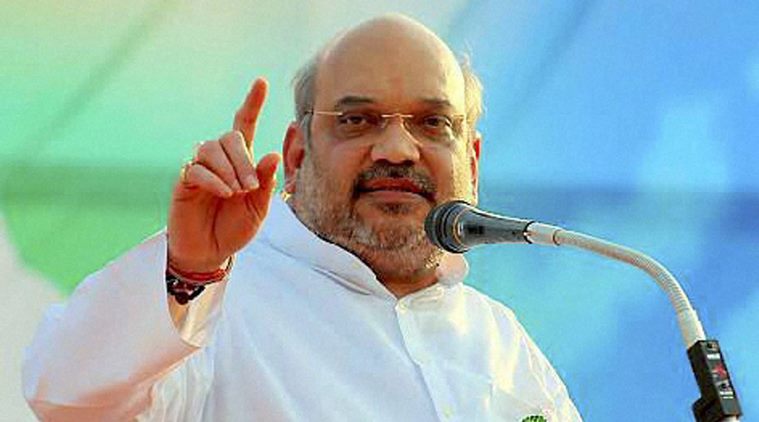

BJP President Amit Shah claimed that the Indian government had recovered $9.75 billion under the income declaration scheme. A total of 64,275 persons declared their unaccounted wealth under the tax amnesty provided by the government. Additionally, the government recovered $21 billion being black money and other undisclosed assets in India and abroad. Recovery of black money was an election promise of Modi during the Lok Sabha polls in 2014. The amount recovered is a far cry from what Mr Modi claimed to be the amount of black money held by Indians in overseas tax havens. The amount recovered under the income declaration scheme is only about 0.5% of the GDP and black money recovered is only 1%.

The unlawfully acquired money kept abroad is routed back to India by round-tripping processes. Round-tripping involves getting the money out of India to a tax haven and then sending it back to India as investments to earn tax-favoured profits. Two topmost sources of the cumulative inflows from April 2000 to March 2011 are Mauritius US$54 billion and Singapore US$11.9 billion. It is wrong to assume that all the investments are by Indians using black money. There are many foreign investors who are investing in India in order to capture market growth and higher capital returns.

Some reports claimed that some US$50 trillion Indian black money is stashed in Switzerland. Reports released by Swiss Bankers Association and the Government of Switzerland claimed that these reports were false and fabricated, and the total amount held in all Swiss banks by citizens of India was only about US$2 billion.

Indian companies invariably under invoice their exports and over invoice their imports from tax haven countries and keep the difference in those countries. Software companies book fictitious exports as they are exempt from income tax.

But then the interest rates offered abroad for US$ currency is negligible and there is no capital appreciation if the money is held abroad. So, Indians are routing their foreign funds, as soon as possible, back to India as the capital appreciation in Indian markets is far more attractive than other forms of investments overseas.

Singapore was another country said to hold Indian black money. Singapore Prime Minister Lee Hsien Loong said that India had over $100 billion in a wide range of investments from Singapore over the last decade. “We have actually built up a flow of bona fide good investments into India which is very substantial, and there is a whole community of professionals who are managing this out of Singapore,” Mr Lee added in an interview with Singapore media.

Indian people should not have any concern that Singaporean investment is out of black money. Singapore has an efficient administration. Singapore PM will not say something that can be doubted.

In appreciation of his humility, Indian media reported that PM Lee took a chartered bus from the Airport to his hotel in Delhi. There were comments from readers that Indian politicians should learn from him. I would say that Indian politicians will do better by following him in raising the per capita income of the Indian people to the level of that of Singapore. They could also follow him by having a corruption free government like his.

The recovery for which Amit Shah claims credit is only a natural flow of funds, which would have happened even without the intervention of the government. The government should focus on how to stop the black money from finding its way into foreign tax havens. The loophole exists because of inherent corruption in the Indian bureaucracy and the political system.

India: Recovers black money from tax havens