Bavaguthu Raghuram Shetty (BR Shetty) completed his pharmaceutical education from Manipal in India. He entered politics and became Vice-Chairman of the Municipal Council in Udupi, his native city in India. Shetty immigrated to the UAE in 1973 and worked as a medical representative there. In 1975 he founded New Medical Centre Health (NMC) with his wife as the only doctor.

NMC is now the largest private healthcare provider in the UAE with over four million patients annually across 45 facilities spread over 12 cities and 8 countries, including UAE, Kingdom of Saudi Arabia, Oman, Spain, Italy, Denmark, Colombia and Brazil. NMC was listed on the premium segment of the London Stock Exchange and was part of the FTSE 100 Index. The company was de-listed from London Stock Exchange and was removed from FTSE 100 index at the request of the directors of the company following investigation of potential financial irregularities.

He saw Indian workers lining up to send money to their families in India and decided to take over UAE Exchange in 1980. By 2016, the company had branches in over 31 countries and had approximately 800 direct offices. In 2014, it had a turnover of US$50 billion in money remittance and exchange volumes.

Encouraged by the success of his two ventures, he went on a spree of acquiring existing businesses and founding new businesses without waiting to consolidate his existing businesses. He borrowed heavily from the banks, overstretching his finances. In 2003, Shetty founded NMC Neopharma, a UAE based pharmaceutical manufacturer. Neopharma had its own research and development wing and provided quality medicines at affordable prices. The company also did contract manufacturing for international pharmaceutical companies such as Merck, Pfizer, AstraZeneca, and Boots UK.

In 2012, NMC made an IPO on the London Stock Exchange and raised $330 million. Shetty used the funds to build a speciality hospital in Khalifa City, Abu Dhabi.

B R S Ventures was privately owned by him and not related to NMC. In August 2016, Shetty announced that B R S Ventures would build a 400-bed super-specialty hospital in Udupi in Karnataka, his native town. B R S Ventures owned a hospital in Alexandria, two hospitals in Nepal, and acquired a hospital in Cairo as part of his personal portfolio. In August 2019, B R S Ventures announced plans to invest $5 billion in developing healthcare facilities across India.

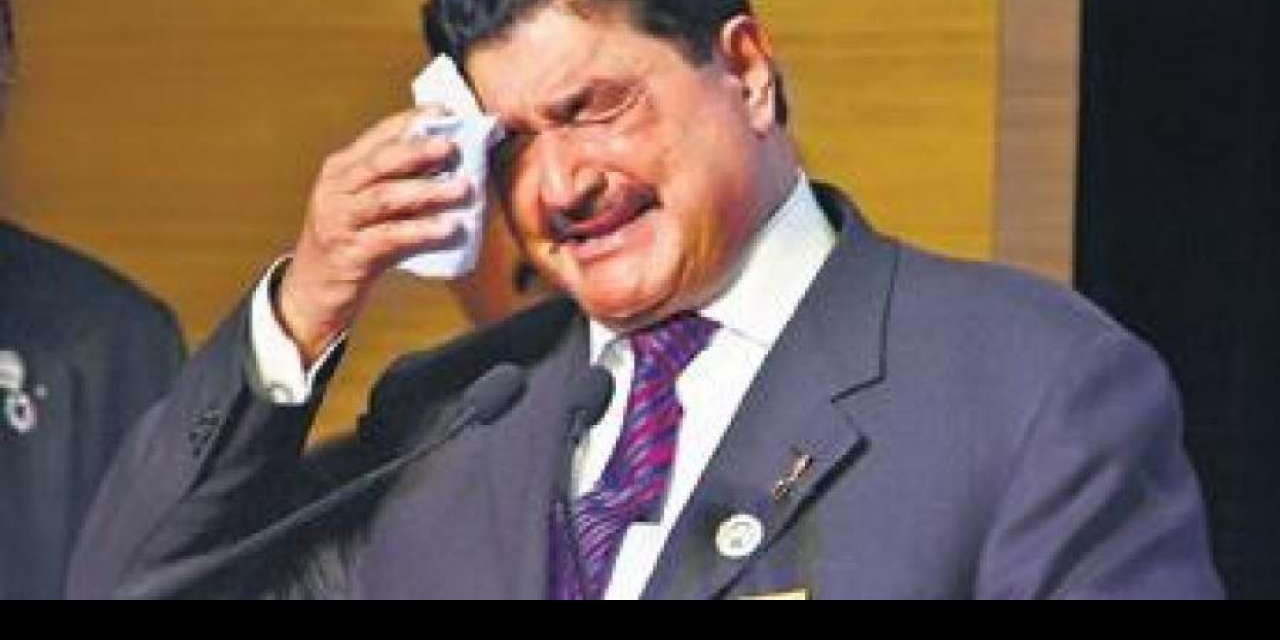

His downfall came when Bloomberg News published a report in February 2020. casting doubt over his real holding and Muddy Waters Research recommended short sell of NMC Health on grounds that the project costs and value of the assets were overstated and the debts were understated. On 8 April 2020, NMC went into Administration in UK due to insolvency of the company and on 27 April 2020, the Central Bank of UAE ordered seizure of all assets of Shetty and his family in the UAE.

Bank of Baroda in India is suing him for not giving 16 properties as collateral for debts and to secure additional guarantees.

Finablr Plc which was worth $2 billion December in 2019 is being sold at $1 to an Israeli-UAE consortium, GFIH. The Israeli partner in the consortium is former Israeli Prime Minister Ehud Olmert. In an LSE filing, Finablr said that the purpose of transferring the business at $1 was to enable GFIH to provide working capital support to the company and to support various stakeholders, including employees and creditors. Finablr is a platform for payments and foreign exchange solutions.

Shetty has filed a complaint with Central Bureau of Investigation (CBI) in India seeking a probe into two former top executives of his companies and two Indian banks. Reuters have seen a copy this 55-page complaint with more than 100 pages of supporting documents. The two former top executives are brothers Prasanth Manghat and Promoth Manghat who were CEOs of NMC and Finablr Plc. Shetty stepped aside as CEO of NMC and Finablr in 2017.

Wikipedia, MoneyControl.com, Reuters, and dna india.