26 August 2019

The government announced on Monday that it has sacked 22 more tax officials accused of corruption and serious irregularities. This comes after Prime Minister Narendra Modi in his Independence Day address, said that “some black sheep in the tax administration may have misused their powers and harassed taxpayers, either by targeting honest assesses or by taking excessive action for minor or procedural violations.”

The finance ministry had earlier sacked 27 senior Indian Revenue Service officers including 12 from the income tax department.

Nine of the 22 officials sacked on Monday are accused of colluding with a cigarette manufacturer to allow cigarettes to be sold without payment of duty.

The government announced on Monday that it has sacked 22 more tax officials accused of corruption and serious irregularities. This comes after Prime Minister Narendra Modi in his Independence Day address, said that “some black sheep in the tax administration may have misused their powers and harassed taxpayers, either by targeting honest assesses or by taking excessive action for minor or procedural violations.”

The finance ministry had earlier sacked 27 senior Indian Revenue Service officers including 12 from the income tax department.

Nine of the 22 officials sacked on Monday are accused of colluding with a cigarette manufacturer to allow cigarettes to be sold without payment of duty.

Another officer who was sacked was accused of conspiracy to smuggle mobile phones and computer parts into India and removing them from the Bengaluru international airport. Another tax official working at the GST office in Delhi was caught last year when he was trying to help a person smuggle 10 bars of gold weighing 1,200 gm from Dubai. He was caught by customs officials.

Many of the officials compulsorily retired had been arrested by the Central Bureau of Investigation in the past. Some others had faced inquiries for irregularities, cases for disproportionate assets, collusion and other wrong doings.

Many of the officials compulsorily retired had been arrested by the Central Bureau of Investigation in the past. Some others had faced inquiries for irregularities, cases for disproportionate assets, collusion and other wrong doings.

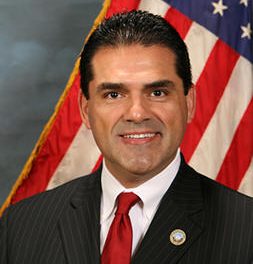

Finance Minister Nirmala Sitharaman (pictured) has announced that from 1 October 2019, all notices, summons and orders by the income-tax authorities will be issued through a centralised computer system and will contain a computer-generated unique Document Identification Number. This is to prevent tax officials issuing notices and summons to individuals and businesses on the sly to make money. After the notice, when the affected party gives a response, the tax department should decide the case within 3 months, failing which the tax notices shall lapse.

These measures will not only reduce corruption but also make tax administration more efficient.

Hindustan Times Reported

These measures will not only reduce corruption but also make tax administration more efficient.

Hindustan Times Reported