18 March 2019

SNC-Lavalin is not the only company caught up in Libyan corruption. Yara International, an Oslo-based fertiliser giant paid the largest corruption fine in Norwegian history and four of its executives were indicted for allegedly paying bribes to win a concession to build a plant in Marsa el Brega and for a separate deal in India, with one defendant receiving a seven-year prison sentence. According to Norwegian and Swiss prosecutors, Ghanem’s son Mohammed served as the go-between in the case of Yara International.

Norwegian and Swiss prosecutors said they discovered Yara deposited at least $1.5m in a UBS account belonging to a company in the British Virgin Islands that was operated by Mohammed Ghanem, according to court documents.

Dutch prosecutors have been investigating a $700m hedge fund in the Netherlands called Palladyne, which was operated by Ghanem’s son-in-law, Ismael Abudher. When his home was searched, Dutch investigators found documents suggesting Mr Abudher owned at least a dozen British Virgin Islands shell companies which were used to embezzle money from Libya.

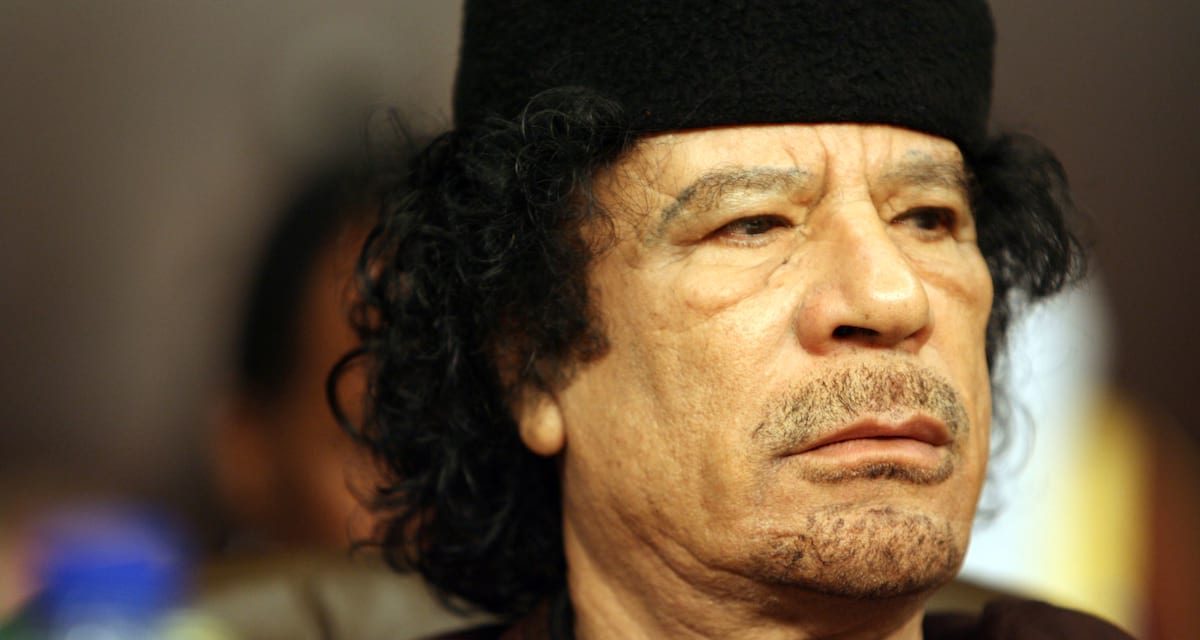

Many secrets about the deals are believed to have gone to the grave with Ghanem, Gaddafi’s last oil minister. He was the alleged go-between for many of the bribes before he defected to the West in 2011 during the final months of the collapsing regime, according to European prosecutors. The Independent reported.

NATO-backed conflict overthrew Colonel Gaddafi in 2011. The country then plunged into civil war in 2014. Current groups of militias are battling for control of the country’s oil wealth which makes up to 95% of the county’s exports, with claims and counter claims of Islamic extremism and terrorism.

Libya continues to face unabated corruption under the present regime. Transparency International ranks it 170nd out of 180 countries on its Corruptions Perceptions Index. Former Libyan consul in Egypt, Adel al-Hassi, alleged that vice president of the Presidential Council, Ali al-Qatrani falsified documents to claim ownership of land that belonged to the Libyan state in Egypt, worth more than US$850 million, which he intended to hand over to his brother Mohammed al-Qatrani.

Last year a US asset manager, Legg Mason, reached a $64m settlement with the Department of Justice (DoJ). Permal, a subsidiary of Legg Mason partnered with Société Générale to win business from Libyan government entities and SocGen paid bribes through a Libyan “broker” for the 14 investments made by Libyan entities, including seven that benefited Permal according to the DoJ. SocGen separately had agreed to pay over $585 million to the DoJ and $292.8 million to the French Parquet National Financier and receive a credit against the U.S. fine, to settle the Libyan bribery case. FCPA Blog reported.

United Nations Office on Drug and Crime (UNDOC) and Libya are working together in areas the of rule-of-law, criminal justice and health and anti-corruption.

UNOC reported.

Ali Mahmoud was appointed chairman of the $60 billion Libyan Investment Authority (LIA) by the United Nations-backed government in Tripoli. He was arrested last Wednesday on prosecutor’s orders, according to Libyan media. Most of the assets LIA oversees are now frozen under UN sanctions.